The Swedish FDI Act – Review of investments in protected sectors

Sweden, like many other countries, has introduced legislation to allow for a review of investment into sectors that are of importance to national security and order. The new FDI Act requires mandatory notification for investments in seven broad sectors or categories of business activities.

Which investments will be captured?

A mandatory filing is required for e.g. indirect or direct acquisitions of 10%, 20%, 30%, 50%, 65% or 90% of voting rights in a Swedish company or assets active within ”protected activities”. Also transactions whereby an investor gains influence by other means as well as intra-group transactions are covered.

Which investors are captured?

All investors are subject to the FDI Act, regardless of their nationality. Intra-EU and domestic investments must also be notified. Only investments from non-EU investors can potentially be of concern and prohibited.

Which sectors are captured?

“Protected services” include a broad scope of services. Activities covered are (i) essential services, such as banking operations, transport, healthcare, and communication; (ii) security-sensitive activities as defined in the Swedish Protective Security Act; (iii) activities related to critical raw materials; (iv) processing large amounts of sensitive personal data or location data; manufacturing, developing, research or supply of (v) military equipment or (vi) dual-use products; and (vii) emerging technologies or other strategic protected technologies, such as AI, biotechnology and information and cyber security.

Sanctions

Sanctions for e.g. failure to notify and implementation before a clearance decision of up to SEK 100 million (approx. EUR 9.4 million).

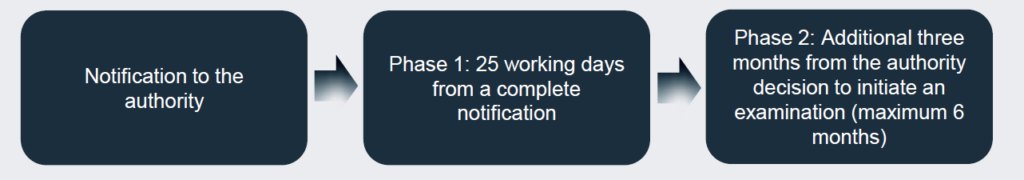

Screening timeline

Key take-aways

- FDI notification will affect the timetable for investments in Sweden and the transaction documents must include due considerations.

- Possible FDI notifications must be considered upfront as investments in Swedish undertakings conducting protected services will become more burdensome, in particular if there are non-EU investors are making the investment, directly or indirectly.

- Regulatory approvals necessary for the transaction, such as national FDI, merger control and FSR processes must be coordinated to ensure an efficient transaction process.

Kontakt

Hittar du inte vad du letar efter?